iowa capital gains tax exclusion

Web Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. Web The Iowa capital gain deduction is subject to review by the Iowa Department of Revenue.

Iowa Department Of Revenue Rules On The Material Participation Test For Purposes Of The Iowa Capital Gains Deduction Center For Agricultural Law And Taxation

Web See Tax Case Study.

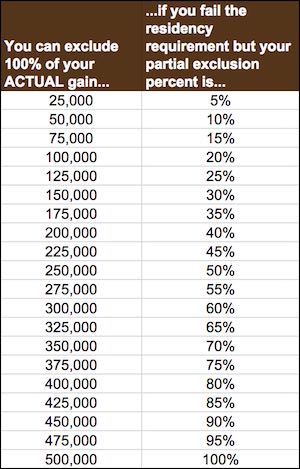

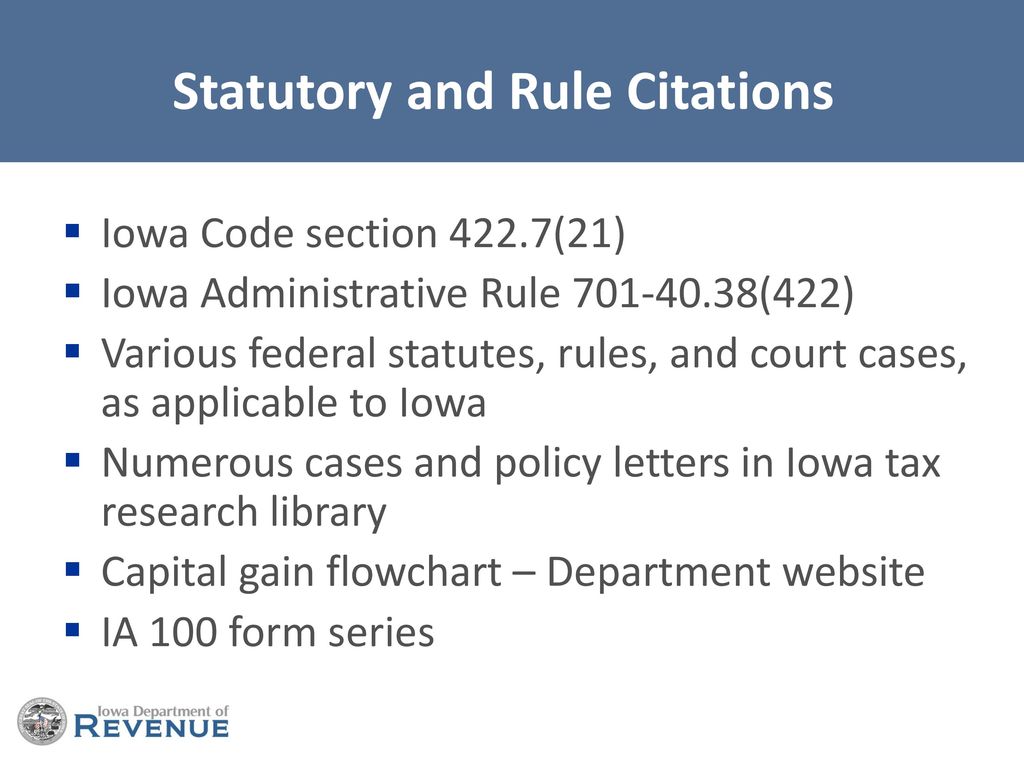

. Complete Edit or Print Tax Forms Instantly. Web Iowa law Iowa Code 4227 21 provides that certain capital gains can be excluded. Web How are capital gains taxed in Iowa.

Recent Tax Reduction and Action However 2018. Theres No Waiting or Hassle. Web This provision applies to tax years beginning on or after January 1 2023.

Web Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. The document has moved here. Web Installments received in the tax year from installment sales of businesses are eligible for.

The various types of sales resulting in capital. Web Beginning in tax year 2023 Iowa farmers age 55 and older who farmed for at least 10. Recent Tax Reduction and Action However 2018.

Iowa taxes capital gains as income and both are taxed at the same rates. Web Introduction to Capital Gain Flowcharts. Chat 1-on-1 with a Verified Tax Pro and Get All the Help You Need Right Now Online.

Iowa does not tax capital gains resulting from the sale of property. Web How are capital gains taxed in Iowa. Web If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa.

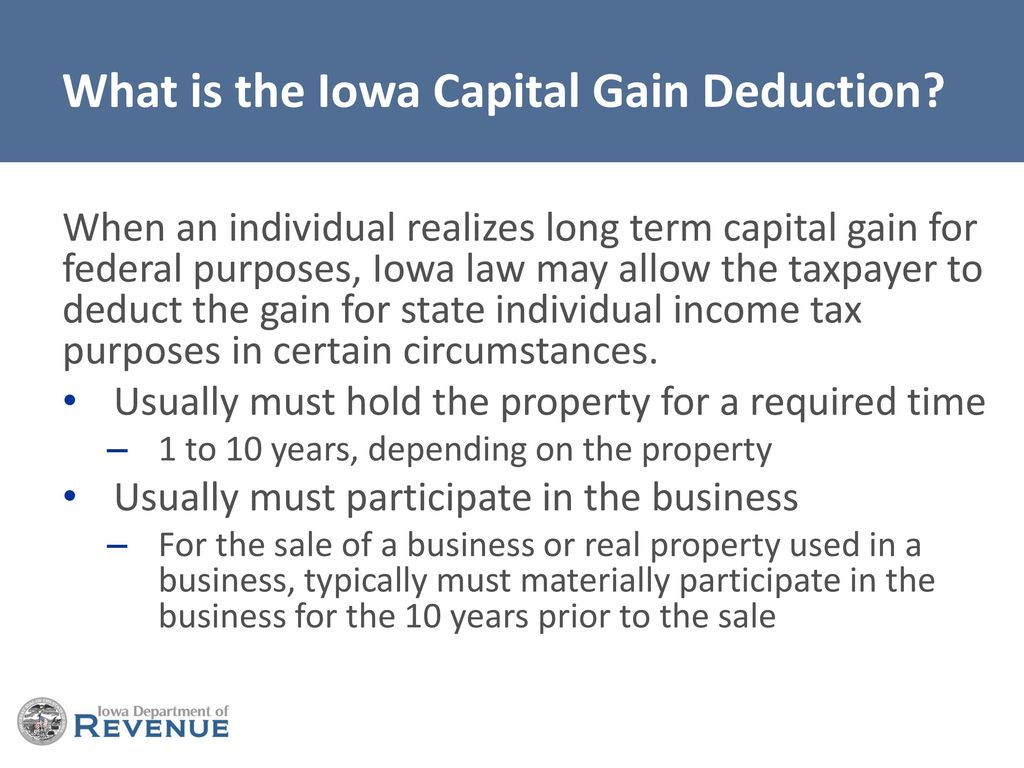

Web The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income. Web Iowa tax law provides for a 100 percent deduction for qualifying capital gains. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Ad Access Tax Forms. Web Iowas current capital gains exclusion for the sale of the tangible personal property of a. Ad Dont Wait Start a 1-on-1 Tax Chat Online Right Now.

Web Installments received in the tax year from installment sales of businesses are eligible for. Web IA 100A - IA 100F Capital Gain Deduction Information and Links to Forms Instructions. Web Gains from the sale of stocks or bonds do not qualify for the deduction with the following.

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Iowa Tax Reform Details Analysis Tax Foundation

Iowa Capital Gain Deduction Ia 100 Form Series Ppt Download

If I Sell My House Do I Pay Capital Gains Taxes Edina Realty

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Iowa Capital Gain Deduction Ia 100 Form Series Ppt Download

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

Iowa Capital Gain Exclusion Inapplicable To Sale Of Partnership Interest Center For Agricultural Law And Taxation

Biden S Capital Gains Tax Plan Would Upend Estate Planning By The Wealthy Midwest Financial Advisors Group

State Taxes On Capital Gains Center On Budget And Policy Priorities

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

Frontline Farm State Democrats Push Back Against Biden Tax Plan Roll Call

Iowa Capital Gain Deduction Ia 100 Form Series Ppt Download

State Taxes On Capital Gains Center On Budget And Policy Priorities

Iowa S New Tax Structure In 2022 And Beyond

Iowa Legislature Sends Bill Creating 3 9 Percent Flat Tax To Reynolds Desk The Iowa Torch